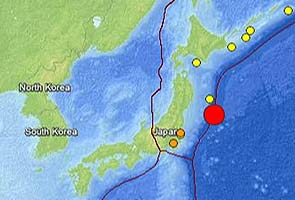

Tokyo: A strong earthquake centred off the coast of northeastern Japan shook buildings as far as Tokyo and led to a tsunami warning for coastal areas of the northeast, public broadcaster NHK said on Friday.

The earthquake had a preliminary magnitude of 7.3, the US Geological Survey said. That was revised from an earlier estimate of 7.4.

A warning for a one metre tsunami was issued for the coast of Miyagi Prefecture in northeastern Japan, which was hit by a devastating earthquake and tsunami on March 11, 2011.

That quake triggered fuel-rod meltdowns at the Fukushima nuclear plant, causing radiation leakage, contamination of food and water and mass evacuations in the world's worst nuclear crisis since Chernobyl in 1986.

The government declared in December that the disaster was under control, but much of the area is still free of population.

Tokyo Electric Power Company, the operator of the Fukushima nuclear plant, reported no irregularities at its nuclear plants after the latest quake.

The earthquake had a preliminary magnitude of 7.3, the US Geological Survey said. That was revised from an earlier estimate of 7.4.

A warning for a one metre tsunami was issued for the coast of Miyagi Prefecture in northeastern Japan, which was hit by a devastating earthquake and tsunami on March 11, 2011.

That quake triggered fuel-rod meltdowns at the Fukushima nuclear plant, causing radiation leakage, contamination of food and water and mass evacuations in the world's worst nuclear crisis since Chernobyl in 1986.

The government declared in December that the disaster was under control, but much of the area is still free of population.

Tokyo Electric Power Company, the operator of the Fukushima nuclear plant, reported no irregularities at its nuclear plants after the latest quake.